Yesterday, we had a nice debate about 529’s. The open question in the end was who benefits from these college savings accounts. The New York Times said that 80 percent of the tax benefits of 529’s go to families that earn more than $150,000. Megan McArdle said that 70% of the accounts are held by families who make less than $150,000 a year. I pointed to our own case of an anemic 529 and wondered how many of these accounts have silly amounts of money. So, who benefits from this policy? Higher income or middle-income families?

The Chronicle of Higher Ed thoughtfully answered these questions for me this morning.

What percentage of American households own a 529 account? The answer = 3 percent.

Not many households have one, in other words.

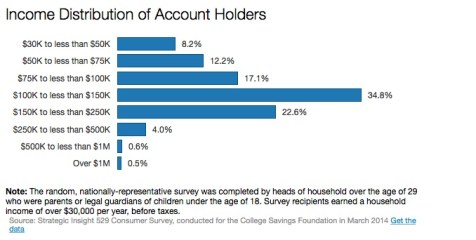

Of that 3 percent, how many are middle income and how many are wealthy? 34.8 percent earn between 100 and 150K per year. 22.6 percent earn between 150 to 200K. 100K to 200K might indeed be middle income, if one lives in the Northeast and bought a home after the real estate boom. So, the majority of 529s are owned by the non-super rich.

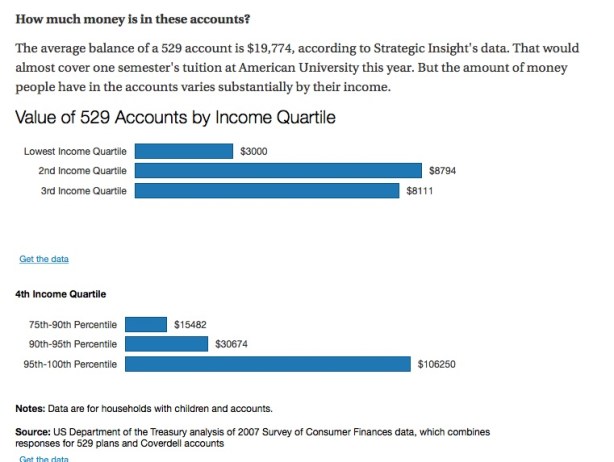

But as I pointed out in the comment section, the real question is how much money is in those accounts. Turns out not much. Only those in the top 5 percent of family income have enough money in those accounts to really pay for college.

As the Chronicle points out, the average amount of money in those 529 is not quite 20K. Those in the 3rd quartile of family income only have about $8K in their accounts.

Still, let’s stick with the 20K number for argument sake. How far does 20K get you in paying for one child’s college education? Let’s just assume the kid finishes in four years, which most kids don’t do.

Georgetown University — $258,160

Sarah Lawrence College — $267,520

University of Virginia — $108,504 (in state) $225,248 (out of state)

University of Delaware — $106,040 (in state) $179,440 (out of state)

The College of New Jersey — $123,572 (in state) $166,024 (out of state)

My next question is whether or not 20K makes a difference. Do colleges first take that 20K and then figure out any merit or other grants? Or do they give out grants first? A middle income family with a nice grant package from a college could put that 20K to good use. It might mean that the kid wouldn’t have to take out any student loans. However, do colleges regard those accounts as their personal property?

Well looking at the charts, for our income we did better than most at putting funds in the 529- it was the equivalent of about half of one semester at our daughter’s pricey private college. My understanding is that it was counted towards the parents ability to contribute when the financial aid package was figured by various institutions. It did actually help my daughter not to take out any loans for undergrad (well, actually she did take out the loans but the money is put aside to pay them off if she graduates in four years), but it honestly did not make that big of difference in where she went. Even though we consider ourselves middle income, she could not have gone where she did if another family member had not made up the difference that we could not. I am not sure what the right answers are, but I dissuade almost all young people from going into to substantial debt for college.

LikeLike

Kiplinger’s just had a fantastic detailed article on college finances that covers a lot of Laura’s questions. tldr: there is very little relationship between sticker prices and what people actually pay.

Georgetown, for instance, graduates students with very little debt compared to what you might expect. I don’t have the issue handy, but I believe the number was around $28k (i.e. the national average for grad debt–which is phenomenal for a fancy pants school in a very, very expensive area).

LikeLike

Here’s the data on Georgetown — http://www.collegedata.com/cs/data/college/college_pg03_tmpl.jhtml?schoolId=1182

Only 37% of students applied for financial aid at Georgetown. In other words, 63% of families had enough money to pay full ticket. You have to be pretty wealthy, to pay for the whole thing.

LikeLike

In contrast, state college have much higher percentage of kids who apply for financial aid. 68% at SUNY Binghamton, 65% at Rutgers, 96% CUNY City College, 64% at University of Alabama, 66% at the University of Kentucky.

LikeLike

What data source does “College Data” pull from? It seems to pull from the College Board’s Annual Survey of Colleges, I guess? http://professionals.collegeboard.com/higher-ed/recruitment/annual-survey That looks to me to be in part marketing. Who fills out the forms? It’s voluntary? The marketing department?

I prefer the College Navigator, which provides information from IPEDS. More data sources. According to College Navigator, 53% of students receive financial aid (which includes federal loans.) 44% receive grant or scholarship aid (for the 2012-13 school year.) http://nces.ed.gov/collegenavigator/?q=georgetown&s=all&id=131496#finaid

Exceedingly important: College Data does not list Net Price. (Not surprising, as it’s a marketing effort.)

Average net price is generated by subtracting the average amount of federal, state/local government, or institutional grant or scholarship aid from the total cost of attendance. Total cost of attendance is the sum of published tuition and required fees, books and supplies, and the weighted average for room and board and other expenses.

Net Price, for Georgetown, depends on the income bracket.

(For students who received Title IV aid by income):

Up to $30,000 in income: $10,197

Up to $48,000 in income: $10,990

Up to $75,000 in income: $15,885

Up to $110,00 in income: $27,224

Over $110,000: $44,727

In comparison to SUNY Binghamton:

$30,000 bracket: comparable. Georgetown is $20 more expensive.

$48,000 bracket: $12,613 Georgetown is $1,623 LESS expensive

$75,000 bracket: $18,324 Georgetown is $2,439 LESS expensive

$110,000 bracket: $20,879 Georgetown is $6,345 more expensive

Over $110,000: $21,655 Georgetown is $23,075 more expensive

So, if you make $75,000 or less, and win admission to both Georgetown and SUNY Binghamton, Georgetown is on average less expensive. If you make more than $110,000, Georgetown is significantly more expensive.

Unless, of course, you win a merit scholarship.

SUNY Binghamton has more students with federal loans. The institutional grant aid is much less generous. 61% of SUNY Binghamton students receive any financial aid; 53% of Georgetown students receive financial aid.

It’s important to make a distinction between applicants and enrolled students when comparing aid figures. There are many students who apply for aid, although they know they won’t qualify.

For a student whose family makes up to $48,000, $20,000 could mean two years at Georgetown. It would cover half a year for a student whose family makes more than $110,000. For that student, it would cover almost a year at SUNY Binghamton.

LikeLike

Cranberry,

Very nice work.

At different income levels, the calculations are very different.

Years ago, when I was deciding between University of Washington and University of Southern California, UW came up more expensive (at least that first year). Same deal here with SUNY Binghamton vs. Georgetown.

Of course, if a kid could live at home and commute to SUNY Binghamton, the financials would be better. When I’ve researched costs for UT Austin, living expenses are 50% of the cost. With a private school, living expenses are a much smaller fraction of the college expense pie.

LikeLike

Cranberry, a better discussion of the sour spot I have never seen. Like I said, my kids will be going to state schools.

LikeLike

dave s.,

You say “sour spot.”

I’ve previously used the phrase, “upper middle class death zone,” but I suppose “upper middle class financial aid death zone” would be more specific.

And our kids will also be going to in-state public, unless they get a particularly sweet deal.

How soon does the lentil regimen begin?

LikeLike

My kids’ 529s were anemic – we never had a lot to contribute and no relatives generous in that area.

Also, I was told by parents of older kids that schools expect 100% of the 529 to be used up front but a much smaller percentage of parental savings, so we focused on retirement and emergency savings.

Now, having been through the financial aid process, I’m sure my younger son would have received the same merit grants regardless (the largest portion of his aid) but less need-based aid if we had a healthy 529. Both kids will emerge with about $20k in loans. Not ideal, but not horrible.

I am much less concerned about who is getting tax breaks and more concerned about college costs rising to suck up anything that helps parents pay. I’d like federal student loans and non-profit status to be tied to schools keeping costs down, educating students well enough to repay those loans, and using a larger portion of their endowment for financial aid.

LikeLike

Wouldn’t doubling the average give a more meaningful picture? Presumably, the account starts at zero, maxes out as the beneficiary reaches 18, and then declines to zero over the next four or five years. It’s the balance at age 18 that matters, not the balances at age 9 and after sophomore year, which is what the average tells you.

Also, the balance per “account” might not be the right number. We have two accounts, one in my wife’s name and one in mine, both for the benefit of our daughter. Really, you have to quadruple the average account balance to get a realistic picture for our family.

LikeLike

Those are variables. we probably shouldn’t generalize from the y81 family to the general population. Examples: multiple 529 accounts — grandparents can hold them, too, and they are now being recommended as a wealth transfer instrument, but, I’m guessing this isn’t relevant to most people. And, when do most people start funding their 529 plants. I’m willing to give a doubling of the 20K to estimate the task benefit. It would come out to 3000-6000 dollars, based on whether you were in the 15% or 30% bracket. Both those numbers are less than the tax credit in the AOTC.

LikeLike

Ah, very smart!

LikeLike

Laura said:

“Still, let’s stick with the 20K number for argument sake. How far does 20K get you in paying for one child’s college education?”

That’s nearly one whole year of UT Austin.

http://finaid.utexas.edu/costs.html

http://bealonghorn.utexas.edu/whyut/basics/finances

Given that the kid can hopefully be working that year, that gives you a good running start on subsequent years of study. You could pay for freshman year with the $20k and then pay a substantial chunk of sophomore expenses with the kid’s freshman year earnings, etc. It allows you to get ahead of college expenses.

$20k is a big deal when dealing with a $100k expense. Ask anybody who has a $40k student loan instead of a $20k loan–there is a substantial difference between the two.

LikeLike

The FAFSA formula assumes that about 5% of parent assets (above a certain threshold) will be used to pay for college, vs ~20% of a student’s assets. So 529s held in a parent’s name for the benefit of a dependent will count toward parental assets. (529s help by a grandparent for the benefit of a student . . . kind of don’t have to be reported on the FAFSA.) 529s should not be owned by a child/student.

Not all colleges use the FAFSA formula; the expected family contribution calculated by schools requiring the CSS profile will be different.

This Forbes article has an accurate and clear description of the various aid formulas used by colleges:

http://www.forbes.com/sites/baldwin/2013/02/28/college-aid-formulas-fafsa-profile-and-consensus/

LikeLike

I should add that, for the purposes of the FAFSA, money in a 529 owned by the parents is counted just the same as money in a savings account in their name.

LikeLike

$20K is nearly a full year at University of Wisconsin too. We set up a 529 with some gift money when kids were born and have been putting $25/month in since birth. It won’t be an enormous amount, but it adds up over 18 years, and will help. I’m working part time now, and I’m counting on bumping up to full time during the college years to cover the difference. hopefully…I feel woefully uninformed about the cost of college and how to make that all work!

LikeLike

The relevant number for the 529 plan benefit isn’t how much is in it, but how much is tax-advantaged. $25/month/18years is $5400. Assume it doubles (not realistic, since it isn’t pre-funded), and you’re in the 30% tax bracket, and the tax benefit is $1620, less than the one year AOTC (if one makes under 180K), and $1620 doesn’t pay for a lot of college.

Same goes for the 20K benefit — how much does $3000-$6000 pay for, not how much does what you’ve saved pay for.

LikeLike

In our particular case, we started with a nice gift, so it’s considerably more than $5,400, but I do get your point…the tax advantages won’t be enormous for us, I’m sure.

LikeLike

I couldn’t read the Forbe’s article without squirming, ’cause it refers to a loss in aid as “taxes”, as in Fafsa “taxes” parent assets . . . .

The article also glosses over the reality that most people with savings and assets, with the ability to manage those assets to maximize Fafsa aid aren’t going to get any. There are a some people, who receive inheritances, have businesses, etc. form whom these are relevant considerations (well, and the people who want to worry about these details to save a few hundred dollars). But for most people, it doesn’t matter.

Lamar Alexander and a democrat have proposed a simplified Fafsa that doesn’t take assets into account. I think there’s a fair argument in favor of that change. True, we might end up giving government aid to a few people with low incomes and high assets, but I don’t think they would be a huge cost, ’cause not many people fit into that category. I heard a report saying that the change wouldn’t be a good idea, because lots of colleges would then develop their own forms, but, I don’t see why that’s an argument against awarding federal money based on a simplified Fafsa.

LikeLike

They talk about a sweet spot for student aid. We are in the sour spot: too much income to be considered for aid, not enough that we feel we can afford private schools. AND we are heading towards having three in college at once. So we squirreled away what we could, including using 529 and also our state’s prepaid tuition plan, and we have told our kids not to consider private schools or out of state, despite the huge number of glossies which are coming in the mail from – privates and out of states.

Colleges would happily take all our money and then we’d be skint in retirement, and none of our kids has come up, yet, with a compelling reason (I must do hotel management at Cornell/materials science at Carnegie-Mellon etc) to go outside the state. I want to be at a school with Big Ten football does not count.

So we are benefiting from 529, in that we are using it since it has some tax advantage. It’s really not causing us to do any saving we wouldn’t do anyway. Ask me in ten years how it all worked out, and I’ll share my swell lentil recipes with you.

LikeLike

20k would get you through all four years in-state at my institution, at least living at home, which is our typical student profile. Even living on campus you’d get at least two years in. Mind you, few people with the resources to put aside even 20k would attend my institution (they’d take the mostly-free ride at UGA instead), but it can be done.

That said I’d expect most people making <100k to be eligible for substantial aid; furthermore I've generally come to believe that saving for college (as opposed to retirement) is basically for suckers and/or the wealthy who can't get Pell and subsidized loans, given the tax and financial aid effects.

LikeLike

Right.

That’s why it makes no sense to complain that only people making $100k+ are doing much with these college savings accounts. Of course–those are the people who (correctly) don’t expect any other help with college expenses. Once you reach a particular income level, it starts being a rational financial decision to save for college. Lower down, it isn’t.

LikeLike

And yet nobody has been able to show me that a sizable amount of families with incomes under 200K use 529’s in a meaningful way. I feel like a government program should have to justify its existence. In this little blog, we shouldn’t have that burden. They should have to show me that a large group of people uses a government program and that it makes a REAL difference in paying for higher ed. If that’s the case, then GREAT. I’m all for it.

And while they’re doing that, I would like some group to demystify this whole college tuition thing. I’ve been reading stuff like crazy and I feel like I’m still in the dark.

We were really good last year. We have a nice pile of money put aside for Jonah’s college tuition. It’s just sitting in our savings account with a mental note that X dollars is for Jonah. But we have no idea of how to protect it, so that we aren’t screwed by the financial aid formulas.

LikeLike

Starting point for a thought experiment: the annual limit on tax-free gifts to other individuals is $10k. FAFSA only asks about the student and (if not “independent”) the parents, not any other relatives.

LikeLike

It’s actually now $14,000/year/person/giver.

LikeLike

$14k? Even better. 🙂

LikeLike

Why aren’t you putting it in a 529 plan? Do you not want the tax advantage?

I’m also not sure why 200K became the threshold. The fact is, college costs have risen so dramatically, they pinch at least the entire 99% (i.e., up to $400K). We have friends with three children in school at once. Paying $150K or even $100K a year out of a $300K income is no picnic.

And those who think spending money on private colleges is stupid should at least be consistent and condemn those who teach there as wicked, on the same moral level as someone who works at an adult magazine or a sweatshop manufacturer.

LikeLike

I went to an expensive private college pretty much free my first three years (before my family suddenly stopped being broke).

Thanks, rich kids!

LikeLike

It might be a better idea for them to put it into retirement. For instance, if Laura doesn’t have her own retirement account, I think I might prioritize that over college savings.

LikeLike

If your tax advantage isn’t substantial, saving in a 529 could be problematic, because it locks the money up for education, unless you pay a penalty (i.e. 10% on earnings, which is especially dramatic when you are in a lower tax bracket). People who take advantage of these plans have to have the money to lock away, not, potentially, need it to pay for a variety of different things one might save for (i.e. down payments, starting a business, etc). Also, I’m confused on this point, but, there’s an implication that non-qualified distributions will be taxed as ordinary income — i.e. no capital gains benefit. Those are risks, if you can’t be certain that the money will be used for educational expenses.

LikeLike

I think spending money on private colleges is fine. What i think is stupid is the government subsidizing spending money on private colleges, especially for, relatively, wealthy people, and when many of our educational systems, from K-12 to public colleges to community colleges are underfunded.

LikeLike

There is not a legal way to protect it so you aren’t screwed by financial aid formulas; that’s kind of what the standardization of aid calculation that the FAFSA brought was for. The only possibility I see would be to put it into an IRA that you later tap and take the penalty. Hard to say if an early withdrawal penalty would offset a school’s need-based offer; I wouldn’t count on it. Like it or not, most colleges are going to expect you to take loans, or Jonah to take loans to pay for college.

LikeLike

But we have no idea of how to protect it, so that we aren’t screwed by the financial aid formulas.

Assuming that financial aid is for students who *don’t have money to pay for college*, how is accounting for money that you have to pay for college being “screwed by financial aid formulas?”

LikeLike

Yup. I’ve never understood it, either.

I think, the math people do, when they have the capacity to save, but worry about the financial aid formulas, is that they think some other family spent 50K on a new car, when they did without, and tried to save money for their kids. Then, come college time, they imagine that family getting aid to replace the 50K while also enjoying the car.

The problem is the risk, the risk of getting the right aid, at the right school. You could find yourself at Harvard, paying 50K more, instead of having the nice car. But, you could also find yourself at U of A, taking advantage of a NMS scholarship, because you didn’t get into Harvard. And, more problematically, you could find yourself at a school, taking loans, because your family didn’t save.

The nice thing about having money in the bank is that you don’t have to rely on the kindness of others (and, except for the guaranteed federal aid, which disappears at fairly low incomes, it’s all kindness).

LikeLike

Here’s a handy ranking of public colleges — http://www.businessinsider.com/smartest-public-colleges-in-america-2014-10

LikeLike

RE: whether $20K makes a difference, I read this article just six months after the birth of my older son: http://www.nytimes.com/2009/04/19/education/edlife/lieber-saving-t.html?pagewanted=all&_r=0. Rereading it now, I realize that the $60K cited in the article is “the current average cost of attending four years at a public university.” At the time (due, perhaps, to sleep deprivation) I misinterpreted this figure as representing the future likely cost of a public college education for a newborn at the time.

Perhaps we’ll rethink our saving strategy, which hasn’t really been a holistic strategy. I started 529 plans for both our kids simply because it seemed to be the best place to put our savings for college. Should we be prioritizing other kinds of savings? Probably. But when I opened the accounts, I was freaked out by the idea of paying large sums to an institution every year. Now that we’ve been paying for private daycare/preschool for several years, I’m less freaked out.

LikeLike

And yet nobody has been able to show me that a sizable amount of families with incomes under 200K use 529’s in a meaningful way.

We are a data point of one, but we are well under 200K (although somewhat north of 100K) and we have around 40K in our 529 for two kids. Is that meaningful? I hope so.

If the idea behind phasing out 529s is that only the rich (who could afford to pay for college out of pocket anyway) take advantage of them as merely a means to avoid paying taxes that they otherwise would have (an argument that I think has some merit) then why not phase out the tax advantage for those above some income level, the way the child tax credit is?

LikeLike

That sounds fair to me, jay.

I don’t care if there are private colleges for the rich, as long as there are no-frills, but quality public colleges for everybody else, ie fully staffed core majors, properly compensated staff, no sports, cinder block dorms. And students and parents leave with modest amounts of debt. Of course, it would be great if it were free, but that’s not happening.

If low and middle income families can’t afford their local state colleges, then we have to rethink everything.

LikeLike

“no sports, cinder block dorms”? That most assuredly does not describe the public universities that we look at or that I attended (i.e., Virginia, Michigan, Wisconsin, and Cal). Maybe it describes some institutions in the northeast, but not in the rest of the country.

LikeLike

I agree (except for the sports/cinder blocks — I don’t think a lot of money should be spent on those things, but I don’t think school should be no fun, either).

There’s a big variation among states in the costs of public 4 year colleges, but I’m not sure how much this is simply correlated with living costs, which in turn is correlated with labor costs.

But, what price point is that? In the NE, the range goes from $7000 (NY) to $14,000 (NH)

http://trends.collegeboard.org/college-pricing/figures-tables/tuition-fees-sector-state-time

LikeLike

Couple more thoughts:

Laura could take the money earmarked for Jonah’s college and put it in cash in the mattress (or a safe deposit box). Then (although it wouldn’t earn any interest) you could avoid reporting it as an asset on the FAFSA and, while wrong, I don’t see how you would get caught. Don’t worry, college aid officials have thought about all the possible ways families try to use to make themselves appear needier. I would just be grateful that you have the money earmarked.

If Jonah is a B student or better and does reasonably well on the SAT/ACT (I would say 80th percentile or better), most colleges are going to initially offer at least $10,000 off their sticker price. Really, almost no one except foreign students pays $65,000/year out of pocket. Even the very, very wealthy are likely to get some merit aid.

Regarding expensive cars: several exclusive, expensive colleges not only require the CSS profile instead of the FAFSA, they will have their own supplement to it. When we filled this out for some schools for my daughter three years ago, some places did indeed ask about the make/model/year/value of all vehicles in the household.

My experience? We have one in college now with another on his way next year. We are definitely middle income (under $100,000), with a modest home value in the Midwest. The kids each have about $30,000 in 529 plans (largely due to gifts from grandparents) and are attending/will be attending private schools, one in the $60,000 range, the other about $40,000. In addition to merit aid for both kids, my daughter has gotten some minor need aid (about $5,000/year, plus the offer of loans which she did not take). I suspect my son’s need aid will be about the same, possibly more for the year that we’ll have two in college at once.

LikeLike

“Laura could take the money earmarked for Jonah’s college and put it in cash in the mattress (or a safe deposit box). Then (although it wouldn’t earn any interest) you could avoid reporting it as an asset on the FAFSA and, while wrong, I don’t see how you would get caught.”

Bad karma on that one.

LikeLike

Much shorter description of Fafsa & assets: http://www.forbes.com/sites/troyonink/2014/02/14/how-assets-hurt-college-aid-eligibility-on-fafsa-and-css-profile/.

It makes a difference which financial aid form you use. For example, you don’t have to list a $2 million family-owned small business when applying for college aid on the FAFSA, but you do on the CSS Profile. Your home equity will count on the CSS Profile, but not the FAFSA. If your child owns a 529 college savings account, it will be treated way more favorably on the FAFSA than the Profile. Assets in retirement plans don’t count, but last year’s retirement contributions do. They get added back to your income for aid calculation purposes.

The answer is likely, fill out both profiles, to find out which one works better.

I would not be in favor of a system which did not take assets into account. I know people with non-high incomes and high assets. Is it fair to give financial aid to someone who owns a vacation property worth hundreds of thousands of dollars? Is it fair to shelter a family’s weekend house, which would mean offering less aid to people who don’t have weekend houses? There are many middle-class families in our area who’ve managed to hold onto the family cottage at the beach or in the mountains. Some are shared between siblings, which makes everything more difficult.

LikeLike

Btw. I wasn’t suggesting hiding away Jonah’s earmarked money. I was weighing put the extremely small pile of cash into the 28-year mortgage or starting a special needs trust for his brother. I shouldn’t have brought it up though. Sorry.

LikeLike

That’s an interesting problem.

CPA?

LikeLike

yup

LikeLike

Cranberry, you’re talking about me! I’m a middle-class professional on a modest salary (sub 100K) with an ancestral beach house/money pit that I share with my siblings, far away in another state. It’s worth a lot, but no one wants to sell, and I can’t imagine how three siblings with eight kids could work out borrowing against it for college costs. But I’d feel weird not owning up to owning it, or claiming need over another family that didn’t have such an asset. Does anyone know, how *does* an asset like that count in financial aid calculations?

LikeLike

It always amazes me how upper middle class people classify a “sub 100K” income as “modest.” Does anyone else in my social class have *any* idea what modest means? The *median* household (not wage earner) income in the US for 2014 was slightly less than $54K. A household income of $80K puts you comfortably in the top quartile. Before I moved (temporarily) overseas I lived in one of the top ten wealthiest counties in the country. The median income there is right around $100K.

It’s possibly going to be a struggle to send my kids to the college of their choice because we’ve committed to try to finance private if that’s what they want and have a compelling reason for. And given the hollowing out of public education I have little confidence that the access to a decent public university education is the same as when I was in college. But we (as anyone else in a six figure income bracket) will have little difficulty sending our kids to our state school at the cost of a modest cutback in restaurants and vacations.

I have no trouble with the idea that financial aid resources are going to be directed away from people like me, though. I want that money being directed towards kids for whom an education would otherwise be out of reach, not going to me so that for the ten years before my kids went to college I could eat in nicer restaurants and take an extra vacation a year.

LikeLike

As I noted above, the $54K number is deceptive. Most households in the 25 to 64 year old range have income well above that.

LikeLike

I agree that the $54k number is deceptive. It masks the polarization of incomes, which is self-evident out here in the rust belt.

LikeLike

“But we (as anyone else in a six figure income bracket) will have little difficulty sending our kids to our state school at the cost of a modest cutback in restaurants and vacations.”

That is so, so, so not true.

My family is drifting over the six figure line right now and despite our living in an inexpensive area, that is not true. An around $100k income pays for the following for us: one paid-off 2004 Ford Taurus (value probably around $1500), one paid-off 2011 Kia Sedona (paid under $12k last year), a mortgage balance currently at $180k, property taxes that run around 2% of house value a year, $14k in private school a year (and a third child headed that way), some extracurriculars and lots of summer activities (but sometimes I just do 2 music lessons a month for our oldest rather than 4 because the money doesn’t quite go that far), a yearly trip to see grandmas and grandpas (I’ve been taking a kid or two to my family and my husband has been taking a kid or two to his family) and one or two nights away to the big city per year. My middle child is currently sleeping on 18-year-old mattresses–the money hasn’t turned up to replace them yet.

Now, there are some frivolities–household help, Starbucks, and very, very occasional casual dining outings (last date night was Chipotle’s). And it sometimes feels like we spend a lot of money on the frivolities. However, my husband recently did the calculations, and as I recall, basic core expenses (mortgage, school, electricity, insurance, water, etc.) is about 5X more than our discretionary expenses (camp savings, housecleaning, meals out, Christmas, travel, school lunch, etc.). Even if we stopped entirely with all travel, Christmas giving, summer camp, extracurriculars, household help, meals out/Starbucks, school lunch for kids, blow money for me and my husband, Netflix, etc., it still only adds up to a thousand something dollars a month. We could totally stop all of that and not come up with the $2,000 a month we need for UT Austin. And there’s no “easily” about it. Now, I suppose we could get to the $2,000 if we stopped all charitable giving, but again, there’s no “easily” about this stuff. And once we get to the year with two kids at UT Austin (or equivalent), all bets are off. Now, I suppose we could stop doing the private school thing, move out to the suburbs, and reach “easily,” but the kids are doing well, and I don’t believe in messing with things that are working.

LikeLike

An around $100k income pays for the following for us:

I think this may illustrate lubiddu’s “different world” point. Leaving aside the charity part, I suspect that without even thinking about it, you pulled out something close to $10,000 in retirement contributions. Which is what you are supposed to do (speaking as somebody who takes advantage of his employer’s 1.5x 401k match.), but still, the idea that you determine what you can afford after meeting needs that current exist only in an actuarial sense indicates a relatively high-level conception of “difficulty”.

LikeLike

“I think this may illustrate lubiddu’s “different world” point. Leaving aside the charity part, I suspect that without even thinking about it, you pulled out something close to $10,000 in retirement contributions. Which is what you are supposed to do (speaking as somebody who takes advantage of his employer’s 1.5x 401k match.), but still, the idea that you determine what you can afford after meeting needs that current exist only in an actuarial sense indicates a relatively high-level conception of “difficulty”.”

As a matter of fact, no in our particular case. Our personal retirement contributions are a hundred something or so a month. Fortunately, my husband’s employer puts the equivalent of 10% of salary into retirement.

However, you’re correct in principle that there’s a lot of “basic” spending included in there that other people at lower income levels might not even be able to do. For example here are some monthly budget items:

–$200 a month medical/dental/therapy

–$126 life insurance

–100 car maintenance

–$100 home maintenance (a little light, I think, but what we can do)

–$20 electronics replacement and maintenance

That’s $546 a month for the prevention of emergencies. For the medical/dental/therapy, car maintenance, home maintenance and electronics replacement, I keep a sort of “virtual savings” ledger where if we don’t spend all of those funds any particular month, any surplus is saved for the big rainy day (which is generally only about three months away).

LikeLike

That’s a nice retirement plan.

LikeLike

$14k in private school a year (and a third child headed that way)

Yeah, well, there you go. $14K/year for 12 years in any reasonable investment vehicle would comfortably fund three state university degrees. So this is what you want to spend your money on instead. More power to you, but then you can’t turn around and *also* say that college is out of reach.

LikeLike

“But we (as anyone else in a six figure income bracket) will have little difficulty sending our kids to our state school at the cost of a modest cutback in restaurants and vacations.”

That is so, so, so not true…

I should clarify that when I said “modest cutback” I meant modest cutback when your kids are 2 and up, not just when they are 18. Cutting back now to save for later, not the idea that you will have all this discretionary income suddenly now when they are off to college.

LikeLike

MH said:

“That’s a nice retirement plan.”

Amen to that. I like to call it “idiot-proof,” although I’m sure you could figure out some way to screw it up. Maybe “idiot resistant”?

True, sad story: My husband spent six years at his previous employer and got tenure there. We left with almost exactly $10k in his retirement account total.

As they say on the internet, some people’s purpose in life is to serve as a warning to others.

http://thepessimist.com/2013/03/04/the-top-13-demotivators-posters-of-all-time/

LikeLike

Jay said:

“I should clarify that when I said “modest cutback” I meant modest cutback when your kids are 2 and up, not just when they are 18. Cutting back now to save for later, not the idea that you will have all this discretionary income suddenly now when they are off to college.”

Well, THAT makes a big difference.

I thought you were talking about easily cash-flowing college at college time.

I still think that your calculations are assuming that the family has a $100k+ income when their first child turns 2 and going forward, which was certainly not the case for our family. It’s taken us well over a decade of tenure track jobs to hit that particular milepost–we had our first child within a year of my husband taking his first job.

It’s not all financial disasters, though–one good thing we did was to do a 20 year mortgage when we bought a couple years ago, so with any luck at all, by the time our 2-year-old is in college, we will have no mortgage. It’s only the first two that are a problem, particularly the 2023-2024 school year, which is when (hopefully) we’ll have a college senior and a college freshman at the same time.

LikeLike

Anonymous 5:57 and 8:23 are me.

LikeLike

still think that your calculations are assuming that the family has a $100k+ income when their first child turns 2 and going forward, which was certainly not the case for our family. It’s taken us well over a decade of tenure track jobs to hit that particular milepost–we had our first child within a year of my husband taking his first job.

Yeah, whatever. For 2, replace 6. Or not. I’m not your financial planner or your mother. My point, which still stands, is that $100k is not a “modest” income. People at that level are not living hand to mouth and have no trouble funding discretionary expenses. For some people it’s nice vacations. For others it’s restaurant meals or nice cars or home improvements or electronic doo-dads or *private school educations*. For some it’s saving for college.

But this isn’t “modest income.” It’s how the top quartile or top quintile lives. I’m in that group as well. I just think that we should be intellectually honest enough to acknowledge that our problems aren’t most people’s problems. Most people don’t worry about how to fund private school *and* music lessons *and* retirement and still save for college. Even one of these things is a stretch for most people. We should at least be gracious enough to recognize this *and* not expect society to further stack the deck in our favor.

LikeLike

Jay said:

“Yeah, whatever. For 2, replace 6.”

Actually our oldest was 9 or 10 or 11 (just in the last couple years). I forget which one it was. But it took a looooong time to get there. And believe me, there’s a substantial difference between having 16 years to save for something versus having only 9, 8 or 7 years.

Look at Laura–they’re just now starting to think about college savings and their kid is around 15 and they’re well above $100k (if I’m reading the tea leaves correctly) and have kids in public school. (Sorry Laura for using you as an example!)

And I bet a lot of people hit $100k even later–in fact maybe right at college time.

“Or not. I’m not your financial planner or your mother. My point, which still stands, is that $100k is not a “modest” income.”

No, but it’s not the level where one “easily” pays for college, let alone two kids in college at the same time.

“People at that level are not living hand to mouth and have no trouble funding discretionary expenses. For some people it’s nice vacations. For others it’s restaurant meals or nice cars or home improvements or electronic doo-dads or *private school educations*. For some it’s saving for college.”

I’m giving my kids the best PK-12 education I know of in our area. It’s probably not necessary for our middle child (who could probably manage fine elsewhere) or the baby but it is actually a basic necessity for our oldest child, who is on the autism spectrum and benefits from a well-organized curriculum with lots of opportunity for her to shine academically, small classes, the continuity of being in the same school and the same basic group of students from K-12, and an understanding staff and administration. All of that stuff is worth way, way more than we’re paying for it. You read the blog–you know how hard it is for even affluent North Eastern families in districts that spend a kajillion dollars on education to find a good public school for special needs children.

I also suspect that you’re thinking in terms of the two child family. The math is much more forbidding beyond two kids.

“But this isn’t “modest income.””

I don’t think I ever used that term.

I’m not saying it’s modest, I’m saying it’s not “easy.”

“It’s how the top quartile or top quintile lives. I’m in that group as well. I just think that we should be intellectually honest enough to acknowledge that our problems aren’t most people’s problems. Most people don’t worry about how to fund private school *and* music lessons *and* retirement and still save for college. Even one of these things is a stretch for most people. We should at least be gracious enough to recognize this *and* not expect society to further stack the deck in our favor.”

Society doesn’t pay for need-based financial aid for families like ours. (Check out Cranberry’s Georgetown charts.)

That’s why families at our level need to save for college and need to be encouraged to save for college–because nobody but us is going to help our kids.

LikeLike

Jay,

Here are some more problems with your expectation that the family that has an income of $100k at college time should have started aggressive college savings when their oldest child was still in diapers (or at the latest just starting school):

1. the parents’ own student loans (These days, it’s not uncommon to encounter families that are still paying off their own loans while wondering how to pay for college. In the contemporary US (particularly among people 35 and younger), large incomes almost always come bundled with large student loans. Often, even in higher-income families, substantial sacrifices are being made just to cover the student loans.)

2. childcare expenses

3. retirement savings (You’re traditionally not supposed to even start with college savings until you have substantial retirement)

3. the need to save a home downpayment (My husband and I were married 15 years and had three kids before we were able to afford our first home, even with family help. There was some dillydallying, but we were extremely aggressive about paying off debt, saving an emergency fund, and a downpayment between 2006-2013.)

LikeLike

I don’t think I ever used that term.

No, you didn’t. Someone else did, but it was a direct quote.

’m giving my kids the best PK-12 education I know of in our area.

Fine, go ahead. Knock yourself out. As I said, I’m not your mother.

But don’t try to pretend that you are living the way the masses do. Buying yourself the “best PK-12 education” is a luxury of the upper-middle-class bordering on rich. It’s not something that 75-80% of the country has the option to do even if they wanted to. You’ve chosen to spend your abundant discretionary income (and if your own numbers are taken at face value 15% of gross income is *very* abundant) on this rather than saving for college. But don’t pretend that you could choose to very adequately save for college instead if you wanted.

Saving for college is a choice comfortable-to-wealthy people make. Some of us choose not to, but it is an upper middle class affectation that we have the opportunity to do so at all and I get tired of people with six figure incomes (like me) complaining that their backs are against the wall just because they have to choose between all the discretionary things that they would want.

LikeLike

It depends how it’s owned. If you just own one quarter of it outright, you should list that as an asset on the FAFSA. If you and your siblings have formed an LLC or other organization so you can collect rent, take depreciation, deduct taxes, etc., then it can be considered a small business and may not need to be included; if you have a student close to college, you can walk through the FAFSA questions to see.

LikeLike

For the shared family cottage, I would say, find a specialist in this case. I know there are specialists, I just don’t know what to call them. Perhaps a good accountant would know people who do it every day.

I have just witnessed the tensions of families who have to confront the problem. It’s tied up with feelings, especially if it’s something inherited, because there can be a lot of emotional baggage. If the siblings share a property, and all have kids approaching college at the same time, it’s a problem everyone sharing the property will face.

You could rent it out, and use the extra income to pay tuition. You could mortgage the property–I would prefer a mortgage to non-dischargeable student debt.

I have heard of family members buying each other out of shared properties, which is often a good way to go, especially if there’s friction over the use of the property. Some families do have properties held in trusts, but I have no idea how that affects paying for college.

It is, however, a common reason for second houses to go on the market; the children have grown up and moved away, and no one uses the house frequently enough to justify the expense and hassle.

(If you think this is complicated, I gather it can get really complicated when there’s a divorce, one of the parents earn more than enough to put the child into the “full pay” pile, but… that parent refuses to pay. The kid is not eligible for many need-based programs, due to the estranged parental income, but can’t pay the official cost. I think I’ve read some colleges can be merciful, but it’s on a case-by-case basis, and not predictable. Once the child is 24, married, or enlists, he or she has a chance at being judged on his/her own income.

Just to say, there are levels of difficulty.)

LikeLike

I’ve been following this and the previous conversation with some fascination. I don’t have college savings for my daughter (I plan on paying for community college out of pocket), and I don’t know anyone with a 529 plan. There’s no tax benefit for 529 plans at my income level, since the contributions don’t come off one’s paycheck (unlike 401ks or deferred comp). (fwiw, at my income level, nobody’s filling out a 1040. We’re all doing 1040A. Like just about every other single parent, I file 1040A, head of household.) Long before I had a child, the financial advice on savings was “save for your retirement—your kid has other options for college costs, but no one else is going to fund your retirement”. Made sense to me.

So, the folks in my world have “community college”, “sports scholarship”, and “military service” as our plans. I told my daughter not to write off the military; being a veteran opens doors in the public sector (veteran’s points).

But…most of my fascination isn’t with the (crystal clear) class differences, but with the arcane, almost alchemical knowledge of the processes. For example, I’ve never heard of the CSS profile until this thread. I googled it because I had no idea what was being talked about. I have no idea about all the college rankings, and don’t bother to learn because it’s unaffordable anyway (just like pricing expensive vacations when your budget is “drive to visit a relative, sleep on their couch”). I do know that the University of Illinois has good rankings, but is shit for financial aid, even for working class students.

Anyway. Window on a world. For me, this conversation is taking place on some outlying planet I’ve never heard of, much less been to.

LikeLike

I never heard of a CSS profile either and I’ve been affiliated with various universities since 1989.

LikeLike

I agree, too, Lubiddu. I teach at a uni (contract, not tenure-track) and had never heard of the CSS profile, nor have I broken 50K/year (in my early 40s). Can I homeschool my child for college?

LikeLike

1. I might have heard of the CSS once this year, but that’s it.

2. Do check out the Kiplinger’s article. The top universities on their list are name schools that graduate with below national average or average student loan levels. At the top of the pile, Princeton graduates students with only $5k in debt total. That’s extreme, but it gives you an idea of how profoundly different universities are. There’s actually a trend at the high end toward offering no-loan financial aid.

http://www.kiplinger.com/article/college/T014-C000-S002-kiplinger-s-best-college-values-2015.html

I didn’t page through far enough to see if the online version has it, but the print version (Feb. 2015) has pages and pages of charts comparing colleges.

3. What you’re seeing in this thread is a discussion with people who are particularly up on the details. Note that even Laura didn’t realize how the income inflection points work for SUNY Binghamton vs. Georgetown.

A lot of higher income people that aren’t higher ed minded don’t know a quarter of this stuff.

4. As to why it’s so arcane and opaque–I think that that’s at least 80% because they really don’t want people to know. It is a shell game.

And, as a matter of fact, there’s way more benefit for colleges to keeping higher-income people in the dark than there is to keeping you in the dark. You cannot be bled for $60k a year, but high income people can be.

LikeLike

I’ll add to my point #3.

A lot of high income people are frankly pretty ignorant about college issues or are engaging in wishful thinking.

A week or so ago, I was talking to a guy on another online forum who is expecting his fifth child. Their household income is around $120k (or something similar). Anyway, they aren’t planning to save for college or adjust their family planning at all to account for college expenses. I definitely got the vibe that he was of the “la la la I can’t hear you” school of financial planners. And what made it particularly irritating to hear about was that he said HIS college had been paid for via inheritance. He was claiming that grocery employees without college can make $50k, so there’s no need for his kids to be fussed about college. (Apparently he’d lived worked in a store in one area where that was the case–in Seattle?)

I thought I should share the $50k grocery employee story with you lubiddu, as it’s such an interesting example of upper middle class parent wishful thinking.

LikeLike

You would be eligible for the AOTC, though, and that’s a refundable credit. I hope it’s still around when your daughter is college age, and that we haven’t retired it in favor of 529 plans.

LikeLike

I completely agree lubiddu. The attitudes are so very different than those I grew up with. The idea that 20K wouldn’t really make a difference!!?! Insane.

But with regard to knowledge of the processes, there is no alchemy. I learned by going to the library when I was in high school. This was before the internet, so I pestered the librarian and looked in books of scholarships, college listings etc. When it was time for my kids to go, it was so much easier. I just used google. I am frequently shocked at how bad many college educated people are at research. I have been talking to some colleagues and they don’t even know what tuition reciprocity is. The first result from a google search of how to save on college costs includes a description of tuition reciprocity.

LikeLike

About 1300 students are going to enroll as first years at Princeton this fall, and 1500 at Georgetown. The top twenty or so colleges don’t have to offer merit aid because everyone who goes there is smart. These colleges’ student aid packages and graduates’ loan balances are not at all representative. The vast, vast majority of this year’s 3 million high school graduates (maybe half will attempt college) are going to get a financial aid package combining merit aid, need aid, and loans, along with an offer of a job that might net $1,000; the balance is expected to come from the parents (cash flow, savings, and/or loans).

LikeLike

Or, an alternate view is that the top colleges have raised so much money for financial aid, that they are able to meet need for kids who would not qualify for need-based aid at less wealthy schools. This magically creates the perception that everyone there is smart. And perception becomes reality.

Play around with Harvard’s financial aid calculator: https://college.harvard.edu/financial-aid. A family in New Jersey, with one child in college, income of $150,000, and $100,000 in real estate equity (not the family’s home), would receive a scholarship of $42,950. Net cost would be $19,600, including an estimate for books, personal expense, and travel costs. Adding a second child in college increases the scholarship by $3,000.

If your child is very, very smart, the college financing picture is very different than if your child is not. Financing offers depend upon the child. I would not assume that college cannot be financed, for a very smart kid. It is an area which rewards research. It is unfortunate that the “sticker price” discourages families from considering colleges which might offer a better deal than their default choices. It is even more unfortunate that (according to an NPR podcast I listened to) many public school counselors do not have training in financial aid issues.

As a number of colleges have been caught fudging their official test scores, I would not underestimate the value of a good score. If you’re willing to travel to a distant state (geographical diversity), or attend a college in which you will increase their score averages.

Service academies (West Point, Annapolis, Air Force, Coast Guard, Merchant Marine) are essentially free, but there are necessary expenses. Applying to service academies is a very involved process, and involves service obligations after graduation.

LikeLike

This is a very good point. Our system certainly offers opportunity to kids who are very, very smart. They can go to a top 25 college, without bankrupting their families or incurring an unsupportable level of debt. But for kids in the dull middle, from families not in the one percent, the steady escalation of college cost over the top 30 years is approaching a crisis. (When I say dull middle, I mean kids in the 60th to 98th percentile in academic ability, i.e., those who could benefit from higher education.) It’s not clear that there is a good alternative for families with incomes and children in that range.

I will say, what irritates me about these discussions is that there seems to be more vituperation directed against families in the 1% than against the faculty and administrators who have created our current situation.

LikeLike

Y81, I agree about the misplaced anger about the high cost of college in the US.

For the “dull middle” as you describe it, they are in such a trap – too wealthy for enough financial aid and not wealthy enough to afford college without incurring significant debt.

LikeLike

Regarding the anger (sorry — I don’t think I can get this below y81 and Sandra) — keep in mind that nationwide 70% of the faculty you encounter have nothing to do with the high cost of college, and in fact are most likely taking on rapidly increasing work loads with stagnant salaries.

LikeLike

I don’t know why the private colleges are expensive (though my guess is a combination of price not playing a significant role, say, in the decision between MIT/Harvard, the belief that their brand is actually improved by the price, and the maximization of what they can get from each student). But, the public colleges have become expensive because of the decreasing state subsidies. I am angry about that, but not at the colleges.

We subsidized those 68-98% kids, and some of them went on to great things and others to bright futures. Now, they have to be great to begin.

I aim my distress at the 1% (of which I am a part) because I do think that the decrease of public subsidy of a common good is the culprit for many of the negative trends in education (including the overselling of student loans).

LikeLike

Abby and BJ are right, especially about public universities.

LikeLike

State contributions to public universities are not declining because of declining tax revenue. State tax revenue as a percentage of GDP has been remarkably steady over the past 20 years or more. Rather, state contributions are declining because of conflicting demands on the public fisc, and those demands do not include transfers to the one percent, and certainly not 529 plans. If you think that states should spend more on higher education, you need to identify the competing demands on state tax revenues, and decide which are unworthy, not rail about the rich and their Section 529 tax break.

LikeLike

State tax revenue as a percentage of GDP may have been constant, but state support for public education on a per student basis has plummeted. Given that my particular state has a flat income tax, I don’t think that calling for an increase in rates on those who earn more is a worse solution than trying to cut the budget for transportation or something else.

LikeLike

“Service academies (West Point, Annapolis, Air Force, Coast Guard, Merchant Marine) are essentially free.”

No, they are not. You pay for them with your time, and you offer your body as collateral.

LikeLike

One of my cousins got into a service academy and left after two years as it wasn’t a good fit for him. That was the cut off point–that first two years was free, but after two years, staying triggered obligations. My cousin switched to a state school as I recall and has done very well as an engineer.

(Funny story–that cousin’s parents pulled out all the stops to get him in, including getting a recommendation from an Indian chief.)

LikeLike

I have a friend who (I believe) has a household income of right around $100k. Problem is, she herself has $600 in student loan payments going out the door every month and she will until her own oldest child is about to go to college himself. They have two kids, a 2 BR 2 BA home, and (I believe) one very basic car.

That family also has substantial ongoing medical and therapy costs and still hasn’t figured out what to do about schooling for their oldest, who has a lot of special needs.

LikeLike

Here’s a provocative piece from The Atlantic on this issue: http://www.theatlantic.com/business/archive/2015/01/the-rich-the-poor-and-whether-tax-policies-live-or-die/384947/

LikeLike

Good article. It agrees with me :-).

LikeLike

It does seem like this whole debate belongs in a textbook about public choice theory, doesn’t it?

LikeLike

Apologies for breaking the threading analogy–I can’t get in where I want to.

bj said:

“I don’t know why the private colleges are expensive (though my guess is a combination of price not playing a significant role, say, in the decision between MIT/Harvard, the belief that their brand is actually improved by the price, and the maximization of what they can get from each student).”

Here are some possibilities:

1. Everything you said.

2. Strong salaries for professors.

3. Smaller class sizes.

4. More classes taught by actual faculty as opposed to adjuncts or TAs compared to state universities.

So yeah, of course private colleges are more expensive.

LikeLike

I am unconvinced that #2 & #4 are actually true at most private universities (well, except Harvard and it’s ilk, and even there, I don’t know that the professors teach undergraduates, but only a small percent of Harvard is supported through the tuition).

LikeLike

A lot of private universities have a much stronger tradition of supporting undergraduate education than Harvard does.

Re #2, here’s this:

http://www.huffingtonpost.com/2013/04/08/faculty-pay-survey_n_3038924.html

“A growing wage gap between public and private colleges, coupled with the increased reliance on part-time instructors, threatens to degrade academic quality at certain universities, according to a new report from the American Association of University Professors (AAUP).

“The average pay for all types of professors, instructors and lecturers is $84,303 for the academic year 2012-13, but the report noted a big difference between public and private colleges. At public institutions, the average is $80,578, while at private schools, it’s $99,771.

“For a full professor, the average salary at a private university this year is $139,620, a notable hike over the average $110,143 at public colleges, and that difference has been growing. This public-private gap has increased from 18 percent in 2004 to 24 percent in 2013, according to the Chronicle of Higher Education.”

So, yes, there is a public-private pay gap.

And there’s a public-private adjunct gap.

““Public colleges and universities, reeling from immediate and long-term cutbacks in their state funding, have sought to reduce spending on the back of their students, increasingly substituting lower-paid contingent faculty members for more fairly paid tenure-track faculty members,” the report said.”

LikeLike

keep in mind that a lot of private places have moving to hiring predominantly contract faculty — basically longterm adjuncts, though with more stability than adjuncts — and lumping them in with their tenure-track faculty for ranking purposes.

LikeLike

Abby said:

“keep in mind that a lot of private places have moving to hiring predominantly contract faculty — basically longterm adjuncts, though with more stability than adjuncts — and lumping them in with their tenure-track faculty for ranking purposes.”

Our local private college has what it calls “lecturers,” which is basically what you describe.

LikeLike

I’m going to throw in a guess that part of the answer is that it’s not all that true that they are more expensive in terms of cost of providing the education, they are more expensive in terms of sticker price: private schools extract a lot of money from their full-price students which they use to subsidize their poor-but-worthy students. Most students of moderate means get a deal of some magnitude, the full price tuition is sort of an opening offer.

This goes back to our discussion of the sour spot of financial aid: parents at, say, the 80th to 95th %ile of income distribution who get offered bupkis off the sticker price, but for whom full price is going to kill their chances at a comfortable retirement. And those parents are figuring it out in droves, and sending their kids to state schools.

LikeLike

Yes. There’s such a thing as too rich for private college.

LikeLike

Also, I’d like to put a good word in for the ancient tradition of throwing a car into the pot to steer one’s high school senior toward an appropriate college choice.

A little devious and manipulative, but probably in everybody’s best interests long term.

LikeLike

Do you know what the per-student budget of private colleges is? I know Canadian universities (which are all public, basically) tend to be in the $14k-$15k/student, and SUNY is right around there. Are private colleges significantly higher, or is it the same ballpark with huge range of fees?

Whatever it is, the entire financial aid process gives the colleges information to practice just about perfect price discrimination. Who else has enough financial information to figure out exactly how much you can afford to pay for their product?

LikeLike

Donald Farish, pres of Roger Williams, has riffed on this point: “…knowing the average amount spent by a given college or university for an average student would be very useful information – because now the prospective student and his or her parents could determine with some accuracy if they were being asked to pay an amount that exceeded the institution’s cost to educate the student, and whether, therefore, they were receiving fair value for their money.

The problem, of course, is that most institutions do not want the students and parents to know that figure. Take a college that lists its tuition at $30,000. Among private colleges and universities, the average current discount rate (that is, the percentage by which the list price is reduced for purposes of providing need or merit aid) is about 45 percent. Thus, we can deduce that $13,500 of this $30,000 posted tuition is actually being waived for a significant fraction of the incoming class of students, leaving just $16,500 per student to pay for educational costs and to run the university. So anyone paying the full sticker price is paying $30,000 to receive a $16,500 education. (To be fair, the average private college derives about 10 percent of its aid dollars, or in this example roughly $1,350, from its endowment – so that figure – $1,350 – should be added to what the college spends on educating each student.)

Using this adjusted figure, the full payer is receiving a $17,850 benefit for having spent $30,000.

As I said earlier, this is the kind of information most colleges and universities are reluctant to share with prospective students and their parents – and when they are drawn into the discussion, the colleges can become inventive with their explanations.”

– See more at: http://rwu.edu/about/blogs/president/how-much-does-it-cost-educate-undergraduate#sthash.lu920rD3.dpuf

LikeLike

Exactly.

The only way to make the process more personally invasive would be to invite Google and Facebook to help.

LikeLike

The other choice, besides state university, is dropping down a notch for the sake of a merit scholarship. As I have said before, if you can get into Yale, you can get a merit scholarship at Vanderbilt; if you can get into Vanderbilt, you can get a merit scholarship at American; if you can get into American, you can get a merit scholarship at College of Charleston. Now it might make more sense to go to, say, Michigan than to attend American on a merit scholarship, but that’s a choice.

LikeLike

A very detailed look at selective colleges, family incomes, and net price,as of 2008-9, and how it changed since 2001: sites.williams.edu/wpehe/files/2011/06/DP-734.pdf. From the Williams Project on the Economics of Higher Education.

LikeLike

Great conversation, guys. I’ll write a post later in the week about Gov. Perry’s proposal for 10K state college and we can talk about college costs more then.

LikeLike

When you do, it could enlarge the conversation maybe to talk about Western Governor’s University in the same post?

LikeLike

Ugh is what I have to say about Western Governor’s. No one has convinced me that this kind of institution provides anything more than a paper degree. Unfortunately, the work world seems to require nothing more than a paper degree at times. In that situation, I’d rather we get rid of the degree requirement, but I guess there’s a niche that might need filling, and that having it be cheaper won’t be a bad thing.

“A key aspect of WGU is how you can credibly use work experience to enhance your education experience.”

(from the web site — which, to me, means, they are offering paper credentials for experience you already have. The right thing would be for evaluators to actually pay attention to your experience).

LikeLike

The right thing would be for evaluators to actually pay attention to your experience

Yes. As a solution to creeping credentialism, it seems suboptimal. As a solution to people needing education, it seems even more worse. Anyway, I’ve managed to work without the right credential for nine years at the same job. The biggest problem is mostly correcting people who do insist on calling me “doctor”. That and I can’t job hop very easily because the number of people who will pay me what I currently make without a higher credential is small.

LikeLike

To Dave S.’s quote from Donald Farish, February 1, 2015 at 3:25, I’d disagree that the average discount rate tells you the value of the education. The value of a good is what you’re willing to pay. Different people are willing to pay different amounts. Different people are offered different prices.

Harvard could sell places in its freshman class for millions. It doesn’t. The tuition cost it sets, even the full pay level, doesn’t come close to the resources supporting the students. In the paper, “The Changing Selectivity of American Colleges,” Caroline Hoxby estimates the most selective colleges in 1962 today offer resources of about $92,000 per student (in 2007 dollars). Note on graph: “Note: Student-oriented resources include spending on instruction, student services, academic support, and operation and maintenance of facilities. Student-oriented resources do not include spending on research, public service, hospitals, and various other categories of spending.”

I recommend the Hoxby paper (and other papers) to understand the issue.

I understand why Roger Williams University’s president would want to state that the resources per student would be the tuition less the discount rate. That ignores spending from endowments, and state support (if applicable.)

I looked up RWU’s figures. From what I can figure out, the students at the closest branch of the state university system have higher SAT scores; the tuition and overall cost is lower at the state university, too. The state university’s also more selective.

LikeLike

Much of this is actually for the benefit of parents who want the right decal on their rear windows. People will go through Hell for that decal. I don’t know why they don’t just buy the fuckin decal and send the kid to Flotsam and Jetsam State U., it’s be a lot cheaper.

LikeLike

I was going to sell decals that said “Safety School” but then I got lazy.

LikeLike

The rumor about Harvard is that it does, actually – $5 million to admit an academically qualified person who didn’t win the beauty contest, $10 to admit a not-qualified person. Discreetly, though, and not most of the places. When I was a TA there I had some students who seemed not up to snuff, so this seems plausible to me, and my good friend who went to the College told me once, ‘we knew who belonged there and who didn’t’.

LikeLike

Not a rumor, at least not for me. I don’t want to name some of my daughter’s classmates’ parents, since they are my friends (but you would know their names). The number I heard, for those who were qualified (which was pretty much everyone at my daughter’s school) was $2 million for Yale, something in six figures for Penn. Maybe it is $5 million for Harvard, or maybe it’s closer to the Yale number. I know a girl who got in that way (her stepfather definitely could make it $5 if he had to), but she flunked out.

LikeLike

Doesn’t that only work for children of alumni?

LikeLike

MH: No, the development office is happy to speak to non-alumni who want to make six or seven figure donations. Most customarily, if not an alumnus/a, one would reach out to a friend whom one knew to be active in alumni affairs for the target school, remind him or her that one’s child was a rising senior, and seek an introduction to an appropriate development office staffer.

LikeLike

“I know a girl who got in that way (her stepfather definitely could make it $5 if he had to), but she flunked out.”

Wow! Awkward Thanksgiving dinner conversation.

LikeLike