Yesterday, we had a nice debate about 529’s. The open question in the end was who benefits from these college savings accounts. The New York Times said that 80 percent of the tax benefits of 529’s go to families that earn more than $150,000. Megan McArdle said that 70% of the accounts are held by families who make less than $150,000 a year. I pointed to our own case of an anemic 529 and wondered how many of these accounts have silly amounts of money. So, who benefits from this policy? Higher income or middle-income families?

The Chronicle of Higher Ed thoughtfully answered these questions for me this morning.

What percentage of American households own a 529 account? The answer = 3 percent.

Not many households have one, in other words.

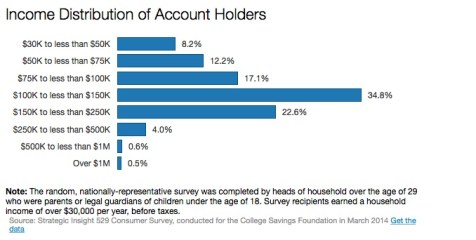

Of that 3 percent, how many are middle income and how many are wealthy? 34.8 percent earn between 100 and 150K per year. 22.6 percent earn between 150 to 200K. 100K to 200K might indeed be middle income, if one lives in the Northeast and bought a home after the real estate boom. So, the majority of 529s are owned by the non-super rich.

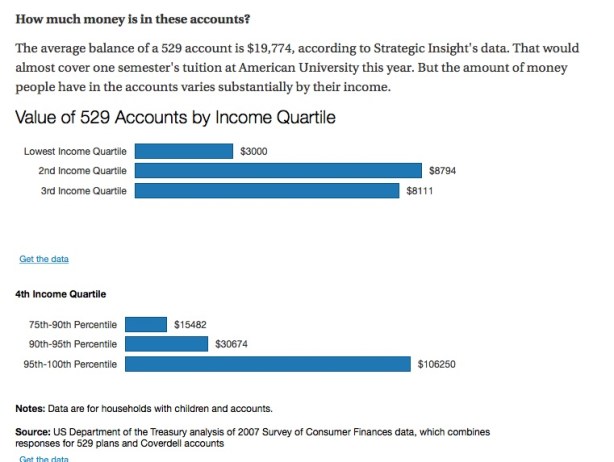

But as I pointed out in the comment section, the real question is how much money is in those accounts. Turns out not much. Only those in the top 5 percent of family income have enough money in those accounts to really pay for college.

As the Chronicle points out, the average amount of money in those 529 is not quite 20K. Those in the 3rd quartile of family income only have about $8K in their accounts.

Still, let’s stick with the 20K number for argument sake. How far does 20K get you in paying for one child’s college education? Let’s just assume the kid finishes in four years, which most kids don’t do.

Georgetown University — $258,160

Sarah Lawrence College — $267,520

University of Virginia — $108,504 (in state) $225,248 (out of state)

University of Delaware — $106,040 (in state) $179,440 (out of state)

The College of New Jersey — $123,572 (in state) $166,024 (out of state)

My next question is whether or not 20K makes a difference. Do colleges first take that 20K and then figure out any merit or other grants? Or do they give out grants first? A middle income family with a nice grant package from a college could put that 20K to good use. It might mean that the kid wouldn’t have to take out any student loans. However, do colleges regard those accounts as their personal property?