I’m in that delightful phase of the writing process, where the first draft is done and is awaiting a red pen from the editor. The heavy lifting is finished, and I can still pretend that every word is brilliant and every point clear. In this window of optimism and light, let me throw out some links to things I find interesting.

What was Bill thinking going into an interview completely unprepared for the MeToo question?

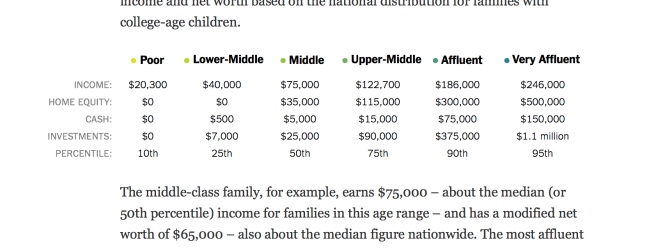

David Leonardt writes that colleges give discounts to the middle class, so you shouldn’t be afraid of the sticker price. Yeah. Lots of people have written that before. Steve and I got stuck on this chart where Leonardt defines who is low, middle, and affluent class.

Those columns don’t work for this area of the country. Let’s take a hypothetical family of two school teachers and two kids. By most standards in this country, a two school teacher family is a middle class family. Here, the mean salary for teachers is about $95,000. With a extra money coming in from tutoring rich kids at $100 per hour, that family easily makes $200K. But they spend all that money on their homes (average home costs is about $600K) and local taxes, so they don’t have any cash or savings.

That two school teacher family cannot afford any of the college on Leonardt’s list.

“What was Bill thinking going into an interview completely unprepared for the MeToo question?”

I think Bill lost a great deal of his … mojo …. after he was under general anesthesia when he had his heart event. Everybody in the party was counting on his remarkable abilities to be there, and they weren’t anymore. This showed in the genius input Hillary was counting on not being there. He has been coasting, and counting on elder statesman respect. It’s gone.

LikeLike

Even without the health issues, a lot of people (especially male people) suffer cognitive decline by his age.

I’m not surprised he doesn’t still have it.

Also, bear in mind that he was a master of a completely different political era–it’s not clear that his particular bag of tricks still work now, even if he had all of his wits about him.

LikeLike

I think, like so many men, Bill thinks he’s different, that 20 year olds really are interested in him because he’s just so special. So, he doesn’t think MeToo applies to him because all his “relationships” were reciprocal and consensual and power didn’t matter, just his personal charisma.

LikeLike

the Dems are really tired of him and regard him as a negative asset: https://www.lifezette.com/polizette/dem-chorus-tells-bill-to-apologize-and-please-shut-up/

LikeLike

Yup. He’s definitely “that” guy. And for someone with such talent and vision and smarts, such a huge achilles heel. It’s the “gift that keeps on giving” – ruined Gore’s chances, was an albatross for Hillary. And most of all, Monica Lewinsky has never recovered from it.

I remember driving down to Seattle from Vancouver to hear him speak live (think it was 1992). I was seconded to work in provincial politics at the time. Loved good speech writing and making so much that I’d even download speeches from the White House website. Amazing speaker in person.

Here’s an excellent article about how he could have handled this week’s interview (I’m also surprised that his PR people didn’t prep him for #metoo questions!). http://www.publicseminar.org/2018/06/bill-clintons-symphony-of-hypocrisy-and-rage/

LikeLike

They were NOT all reciprocal and consensual.

LikeLike

The Leonhardt article has interesting data, and, though I was going to be skeptical at first, makes the point that people making less than 75K (50% of the population) will pay <20K at many of the elite colleges. He doesn't make a claim that college will be affordable, defined by one's own personal circumstances, at any income level, including that shared by <10% of the population.

His data is relevant if a family makes less than 75K, but not particularly for people making more than 200K, who are, mostly, full pay.

I read somewhere in a college financial brochure (maybe NYU?) that they expect families to pay for college with past, current, and future earnings (i.e. savings, income, and loans). I continue to be surprised at the number of families who are willing to make that investment and I think that schools are rapidly trying to win the model, to become the kind of school that people are willing to pay for before parents decide any particular college isn't worth it anymore.

LikeLike

bj said,

“I read somewhere in a college financial brochure (maybe NYU?) that they expect families to pay for college with past, current, and future earnings (i.e. savings, income, and loans).”

Well, that’s refreshingly frank of them.

LikeLike

NYU is notoriously stingy, according to the posters on College Confidential.

LikeLike

I don’t know if they’ve cleaned up their act, but a disproportionate number of classic student loan horror stories involved NYU.

https://journalism.nyu.edu/publishing/archives/livewire/money_work/gen_debt/index.html

LikeLike

The Courtney Munna story makes them look absolutely vile: https://www.nytimes.com/2010/05/29/your-money/student-loans/29money.html

We told our kids that if they hadta hadta hadta go to Carnegie Mellon for materials science, we would find a way, but if they were taking a course which could be had at a Virginia state school, to a Virginia state school they would go.

And they have.

LikeLike

NYU is not exactly stingy. Its a money-making exercise, and is not really interested in the education of the students, or getting less affluent students because… it doesn’t have to be. A huge beneficiary of being in the right location when massive inequality emerges.

LikeLike

I don’t think they have cleaned up their act. They are the classic rich,capable kid “safety” school (by which we mean kids with good stats, good curriculum, and the money to pay, and the desire to be at an R1 in NYC).

They don’t meet need with financial aid, though they are need blind (of sorts) for admission. That puts families in the position of deciding whether they are going into debt to pay for the perk and perceived prestige.

But, the quote might have been some other school — except for the schools that meet “full need”, that’s the general policy of private schools, and, even the ones that meet full need expect people making over 250K to save, pay, and take loans. They’d prefer savings + current income, rather than loans, but they expect you to have saved for the 250K + costs of college, say having saved 10K/year since the kid is born, and then expecting to pay another 25K/year for the four years.

LikeLike

I added my comment above before reading this one! Sorry!

LikeLike

In looking at that chart, the example that came to my mind was academics. Many of us now have good incomes on paper, but because we spent our 20s (and for some of us our 30s) toiling away at poverty wages, we don’t have anywhere near the equity, cash, or investments that charts suggests. Which would be fine if colleges actually took “past, current, and future earnings” into account. But my sense is that they really only look at current and future earnings – no adjustments made for spending your 20s at the poverty level. I totally get that was our choice, but on the other hand, it’s not like I was choosing to go on fancy vacations instead of saving for my kids’ college.

LikeLike

I’m not sure where the writers found the data for their financial estimates. I wonder if someone took an average of investments for the 5%? There are quite a few people who earn a lot for a few years, but don’t have a nest egg built up, especially if they live in an expensive area. See: https://www.financialsamurai.com/scraping-by-on-500000-a-year-high-income-earners-struggling/

Our town has a high average income. I see quite a few kids going to state schools, whatever the private colleges might expect. The average parent is an older professional in our town. That means retirement (or being let go) is looming. Even if their income is high, there’s the knowledge that it won’t go on forever. Some still have student debts of their own to pay off. The end of the SALT deduction hits them very hard.

The pattern seems to be to send the children to the most affordable “good” college, retire, sell the house and move to a low-tax state.

LikeLike

We’ve had a couple of examples of YES! Rawlsian veil-piercing in this very pixel patch last coupla days. So exciting!

1. “Even if their income is high, there’s the knowledge that it won’t go on forever. Some still have student debts of their own to pay off. The end of the SALT deduction hits them very hard.

The pattern seems to be to send the children to the most affordable “good” college, retire, sell the house and move to a low-tax state.”

2. People moving to a high-services state after they have a special needs kid, or otherwise find a need for high services. My own first encounter with this was when I was working as an ambulance driver in Oakland in I think 1972, when I transported to the hospital a woman with MS who had moved from Texas couple weeks before because “in Texas they won’t do anything for you”. In my DC office I had a coworker with a kid deep in the autism spectrum who moved from his dream house in the Virginia suburbs to a place he liked less in Maryland, same reason. And, of course, Milton Friedman identified the biggest problem with basic income as, you can choose between open borders or a high level of welfare provision, but you can’t have both.

LikeLike

Those columns don’t work for this area of the country. Let’s take a hypothetical family of two school teachers and two kids. By most standards in this country, a two school teacher family is a middle class family. Here, the mean salary for teachers is about $95,000. With a extra money coming in from tutoring rich kids at $100 per hour, that family easily makes $200K. But they spend all that money on their homes (average home costs is about $600K) and local taxes, so they don’t have any cash or savings.

*First*, I call BS on this. The median home price in NJ is not 600K, it is 315K. And doing a Zillow search, there are plenty of homes west, NW, and SW of NYC at that price or cheaper. If you want to live in a McMansion in the expensive towns and do a bunch of remodels then, yes, you can spend north of $600K. But the idea that you have to is just crazy talk.

And the median household income in NJ is around $80K. If you are making 2.5 times the median household income then you are for sure “affluent.” If you can’t send your kids to college on $200K then nobody in NJ can. And yet, people seem to go.

I’ve said this before and I’ll say it again. Any household that makes that much money can save enough to send their kids to college, *if they make it a priority.* But people think that once they make that much they are entitled to “the good life.” Ski vacations, nice cars, restaurant meals, nice houses, enrichment for their kids, the works. But you have to pick and choose. Sending your kids to an elite private college is also part of “the good life, and if you want that part of it then you have to cut some corners elsewhere. If you don’t, you get to go to the state school (and the honors colleges at the flagship mid-Atlantic schools are also very good).

The singular of data is not anecdote, but allow me one. I have a colleague whose household income, between her and her husband, outstrips mine. Not by a huge amount, but enough to move her up a position on Leonhardts chart. And yet, she is always whining about how expensive college is, how she can’t afford to save for her daughters, and the tragedy that they will be depending on massive loans if they go at all. Not surprisingly, she was a big backer of Bernie, not the least for his promise of college for everybody. Perhaps this is a reasonable public policy to pursue, perhaps not, but she is an avid skiier and her family takes 2-3 ski vacations a year. The cost of those vacations, in and of themselves, is enough to fully fund a college fund for her kids. She chooses to do the vacations instead of the college. Fine. But then, if you are at our income level, DON’T WHINE ABOUT HOW HARD IT IS TO PAY FOR COLLEGE. It’s not. It’s hard to pay for college AND expensive vacations. It’s hard for people at the $75K household income level to pay for college. But it’s not hard for people at our income level to send their kids to college IF THEY MAKE IT A PRIORITY.

If you don’t prioritize it yourself, why do you expect the rest of us to do it for you?

LikeLike

Yes. What Jay said.

Those charts drive me insane because there are so many categories that are not necessarily correlated. You can have high income and no Home Equity. Or a lot of home equity and no investments. And what about things like retirement funds? Or are those considered investments? Argh.

LikeLike

Fortunately, if you click through the story you can access the calculator that he used and construct your own hypothetical affluent/middle class/poor person at each of the schools. It is actually kind of interesting and I spent quite a bit of time playing about with it.

It is, essentially, a stripped down version of the NPCs that most colleges give you, which are in themselves stripped down versions of the complete financial aid calculations. What it does is take the most influential variables from those calculations and look profiles of people with similar values to give you a 5th to 95th percentile range of where you would land with your values of those variables. If you know what the rest of your financial situation is it isn’t hard to project yourself towards the top or bottom of that range.

The most interesting thing to me was the variance within the colleges. If you are UMC you want to get into Bowdoin or Amherst. St. Olaf, not so much. At least, from a financial point of view. (Although those schools are better academically as well…)

LikeLike

I agree with Jay. It is gross to read someone complaining that $200K just isn’t enough, and they just can’t send their kids to college. Let’s remember the chart is for PRIVATE colleges.

LikeLike

Laura was not complaining that the theoretical married teachers couldn’t send their children to college. She specifically referred to Leonardt’s list of private colleges.

Looking at my town, and neighboring towns, the houses are expensive in comparison to the American average. Factors such as commuting distance to high-paying jobs and desirable local schools increase property values, but that means there are families living in town who can’t stay in town in the long run. You see that in the local information published by realtors; the number of people over 59 drops off sharply.

I’ve counted up the names in our local paper; almost 50% of this year’s high school graduates are attending public colleges. The average household income falls into the “very affluent” category. The families seem to have decided they can afford college, but many have decided they can’t afford a private college.

Of course, 3 out of 4 college students in the country attend public colleges. The New York Times tends to obsess about a very small subset of the whole.

LikeLike

But this feels precisely like the Atlantic article of the top 10% looking upwards and feeling poor. As Jay says, the vast majority of people can’t live in a McMansion, give their children expensive enrichment activities, take multiple nice vacations per year, eat out frequently, drive a nice car, remodel their houses, AND pay for private college. Not being able to do all that doesn’t make you “poor,” it makes you not moderately to extremely wealthy. Most people can’t even do a fraction of those activities.

What grinds my gears the most is that these things are presented as needs, not wants or choices. No one “needs” to provide costly enrichment activities for their kids, no one “needs” to send their kids to a private school (secondary & tertiary), no one “needs” vacations, and no one “needs” to eat out at trendy restaurants.

LikeLike

The families seem to have decided they can afford college, but many have decided they

can’t afforddidn’t want to make the trade-offs to send their kids to a private college.There, FTFY.

LikeLike

“The families seem to have decided they can afford college, but many have decided they can’t afford a private college.”

I don’t see this as any kind of hardship.

LikeLike

It isn’t.

It does explain, however, why many young couples are choosing to leave our part of the country for different states, especially states with good university systems.

When I read about Silicon Valley, I fear it’s a window into our future in this town. Teachers and nurses used to be able to afford to live here, but they can’t now. (Or at least, they shouldn’t.) In some towns in the area, there aren’t any houses on the market under $500K.

How far will they be willing to commute?

LikeLike

“It does explain, however, why many young couples are choosing to leave our part of the country for different states, especially states with good university systems.”

This has been happening for centuries. In my genealogy research, I watch as families start in Boston and keep moving west every few generations. That’s what people did when the amount of farmland they could inherit just didn’t cut it any more. They moved for better opportunities. The Great Migration of African Americans from south to north was partially about racism and partly about economic opportunity. We have family friends who grew up on a farm in upstate New York. I spent all my vacations there as a kid. But when the time came, they went to state colleges or the military, then moved to other parts of the country (Albany, Atlanta, Colorado). They didn’t sit on the farm and whine that jobs needed to go to them. They went to the jobs.

We have far more ability to move conveniently and communicate afar than we ever have, but we are even less willing to move.

LikeLike

But there’s another problem that you need economic diversity in a relatively compact geographic space for a healthy modern community. If you price out first the unskilled service workers, then the skilled service workers, then the middle classes, then the upper middle classes, you end up with an unsustainable community. You can’t operate a hospital without nurses, or a school without teachers, a restaurant without waiters, a fire department without firefighters, a neighborhood without garbage collectors or mail carriers, and so forth. If you want arts, you need to be affordable to an artistic class. As you gradually keep hollowing out the community, you eventually end up with ghost towns filled with by investor-owned property and shell companies for global billionaires. In some parts of Manhattan, real estate owners would rather property sit empty than offer affordable rents even for upscale businesses. My husband’s hometown, Venice, is 90% museum and 10% dying town. For Venice it’s too late, and it will be underwater in about 50 years anyways. For places that are more vibrant, I think it’s worth it for communities to promote economically viable living communities.

LikeLike

My relatives live in countries where high quality education through the tertiary level is free and widely available, no one worries much about getting into college, getting a job, healthcare, or retirement. Income is basically for day-to-day living expenses and fun. They travel the world on their extensive paid vacation time, volunteer, and own second homes. We’ve decided as a collective we don’t want this kind of society, where most people are middle class and middle class is comfortable. We’ve decided we’d rather live in a highly-stratified one where even the “winners” feel non-stop status anxiety and deprivation, and the actual losers are killing themselves or dying of easily treatable conditions. I’m not sure why we’re taking places like Russia or Nigeria as our model, but apparently the majority of Americans don’t want to be a first world country anymore.

LikeLike

In many Western European countries with supposedly easy access to tertiary education, access is limited. Just not (directly) by income. The culling happens around age 10-12 when the education system decides who gets to go to university and drops the rest from that track, which it can be almost impossible to get back onto.

For that matter, in which mythical country does a representative person own a second home? (Aside from maybe Norway, which is sitting on a mountain of oil money that boggles the mind.)

LikeLike

You got it. I don’t know the official stats, but I’ve yet to meet a Norwegian family that doesn’t have a second home, and everyone I know has “middle class” jobs (journalists, nurses, teachers, farmers, goldsmiths, engineers, etc.)

Also Scandinavian educational systems don’t track students the way, say, Germany does, plus there is little class difference (status or income) between the vocational or white collar professions.

LikeLike

Second home ownership is probably slightly lower in Sweden and Finland, but also not uncommon, and they’re not sitting on piles of oil wealth. Plus, the US has oil money too, we’ve just chosen not to nationalize the industry and spread the profits to ordinary citizens.

LikeLike

You got it. I don’t know the official stats, but I’ve yet to meet a Norwegian family that doesn’t have a second home, and everyone I know has “middle class” jobs (journalists, nurses, teachers, farmers, goldsmiths, engineers, etc.)

Yes, well, Norway. We have quite a bit to learn from them but they are hardly a representative example and, more to the point, not one that would scale. Their gini coefficient is much better than ours but their GDP per-capita is also about 20% higher. This is due to a lot of factors besides good public policy (small population, an oil generated sovereign wealth fund that is several times their annual GDP, the exporting of much of their excess peasant class to the US in the late 19th and early 20th centuries) that we would find it difficult to replicate.

Also, I question the “everyone I know” method of data analysis. Although the gini coefficients are much better in Sweden and Finland as well, they have their own rural poverty issues. I would wager that some of that is true in Norway as well, although oil money has softened that.

LikeLike

Also, I question the “everyone I know” method of data analysis.

Well sure, it was an anecdote about my relatives’ relative quality of life. Googling turns up that Norway has the highest second home ownership rate in the world. There is one cabin for every 10 Norwegians, with 50% of the population having regular access. It’s 1:12 in Sweden, and 1:18 for Finland, which are also I believe in the top 3. (There is also relatively high cabin ownership in central Europe, and the lowest cabin ownership in Europe is in the UK, not surprisingly also one of the most class-stratified places). But again, you’re confusing monetary wealth here with policy priority. Norway has prioritized cabin ownership since the 1920s, back when it was still a very poor country. From the 50s onward, Scandinavian governments (including Sweden, and before Norway had oil money) have provided policy incentives to make cabins affordable and accessible to people because access to nature is seen as a quality of life issue. Cabin accessibility reflects a general social priority on making a high quality of life accessible to a maximum number of people, which is not something the US government prioritizes.

Obviously there are differences and the US isn’t and doesn’t want to be Norway. (I doubt Americans would want to eat the typical Norwegian diet, watch Norwegian TV, or cross-country ski for 8 hours a day in the winter.) But I’m not sure how most of the things you listed matters vis a vis creating a more egalitarian society with a small divide between middle and upper class. The Norwegian government would have the same priorities regardless of oil wealth, and regardless of emigration. In fact, there’s a way Norway is the most relevant comparison in Europe to the US. Norway has been a nation of peasants since with no broad status distinctions among its populace since the mid 14th century. Given the US is supposedly also a classeless society we ought to assume it would be easier to mimic Norwegian policy and broad social goals rather than those of countries with centuries of feudalism or an extant hereditary nobility.*

*Though of course we both know the real answer is the US has substituted race for class as the basis of social hierarchy, and there’s strong evidence poor white Americans would rather die than support policies that might undo that racial hierarchy.

LikeLike

“You got it. I don’t know the official stats, but I’ve yet to meet a Norwegian family that doesn’t have a second home, and everyone I know has “middle class” jobs (journalists, nurses, teachers, farmers, goldsmiths, engineers, etc.) ”

Right. There are no garbage men, no one works in food service, no janitors.

LikeLike

“My relatives live in countries where high quality education through the tertiary level is free and widely available, no one worries much about getting into college, getting a job, healthcare, or retirement. Income is basically for day-to-day living expenses and fun. They travel the world on their extensive paid vacation time, volunteer, and own second homes. ”

I don’t believe this.

This is not France, Germany, Sweden, Denmark, UK. In all of those people worry about getting into college and young people absolutely worry about getting jobs. It is not Italy, Romania or Albania. Again, people worry about their bills, they worry about getting jobs (and in Albania and Romania they think a lot about leaving.) All places where I personally know people who are considered middle class.

Where is this place you speak of?

LikeLike

I thought Jay’s points were very good. My recollection is that he is not necessarily a favored commenter on this blog, so it is nice to see that I was not the only one with that reaction. As for us, we made a decision to save less for college in order to buy a larger house–in 2008! We’ve got a good public option, and that’s where she’ll be going in the fall.

LikeLike

Wait? What’s wrong with Jay?

LikeLike

Also, if we do care about elite schools, the top ones also make it affordable to the UMC/LUC (lower upper class), since that’s their prime target demographic. IIRC these top echelon schools are free for people with household incomes of 100K or less, and offer significant financial aid up through 300-400K, depending. It’s the bracket below that, the slightly less prestigious “striving” private schools not sitting on multi-billion dollar endowments that are much more stingy. If you can get into Harvard, you can afford to go to Harvard. NYU? not so much.

LikeLike

At 300K income, with 3 kids in college, the NPC calculator for Harvard suggests you’d pay 45K for college. And, with only one kid, it’s 70K. Harvard doesn’t offer what most would call “significant” financial aid for folks who make 300K — that’s expecting a family to 135K for their 3 kids, if they all went to Harvard, or 70K for the one kid.

At 200K income, with 1 kid, you pay 50K for one kid or 26K/kid for three kids (78K).

With the past, present, and future funds, the other assumption of most schools, is not just the stingy ones, another expectation is that the higher your income, the more the expectation of past and future funds is, as well.

I think it’s important for families to realize that the private schools expect people in the top 10% of the national income distribution to save and pay for college; otherwise there’s a lot of wishful thinking and resentment and unwise choices that comes to head when trying to pay for a kid, one who really doesn’t understand the magnitude of the cost and decision being made.

I was impressed at Laura’s willingness to be the adult in the room, our job as parents, when navigating the process with J. It’s really hard to deny your child something they want, and maybe think they need. But that’s sometimes our job as adults.

LikeLike

I’m not sure if this is exactly on topic, but one way or another, old white people with much more money than me complaining about problems (or expecting me to fix problems) that could be fixed for a couple hundred dollars or less are going to be the death of me.

LikeLike

And as well, colleges pull things like this aid offer from University from Arizona:

Total cost of attendance: $48,200 (presumably out of state)

Gift Aid offered: $5815

Self-help options excluding loans $5500

Credit based aid offered $36885

Net costs after all aid: $0

I don’t understand it myself, and can’t imagine trying to explain to a child why they couldn’t go there, if paying was an issue. And, I imagine, one of them is saying “bj’s kid gets to go there”, without understanding what it means for money not to be an issue.

https://www.vox.com/2018/6/5/17425572/college-financial-aid-application-confusing-misleading

LikeLike

Tuscon is nice, if you can take living in an oven for a few months every year. Just avoid Phoenix.

LikeLike

From your earlier comment, for Harvard, at 300K income, a family can make it work. You might have to mortgage the house. You might have to take out loans. You might have to sell your interest in the cottage on the Cape to your brother. You might delay contributing to a retirement fund. However, many families are willing to make it work only for certain colleges.

But, if your kid has the grades and scores to get into Harvard, but doesn’t, the University of Arizona might be very attractive, even from out-of-state. Merit aid is often linked to grades and test scores. An out-of-state top student could receive $35,000 in financial aid.

https://financialaid.arizona.edu/types-of-aid/scholarships/freshman-transfer

LikeLike

The average cost of a home in my county, according to Zillow, is $458K. The average cost of home in my town is $709K. Of course, those are averages, so those numbers include $5m mansions and $200K tear downs.

We made a choice that we would live in fancier town, not because of the homes, but because of the schools and the peer group influence. We could have stayed in a cheaper town, but we felt that it was much less likely that our oldest would have the skills needed to perform well in college. We figured that it was better for him to go to a state college with a solid background than to end up a bad college with a fully funded college account. I think we did the right thing.

And no, they don’t take into account past. I wrote letters to several of the financial aid departments explaining the unfunded PhDs. They said they didn’t care. I also explained the costs associated with raising a child on the autism spectrum and did a spreadsheet with all of our additional expenses. They also said that they didn’t care about this either. Now, Jonah only applied to state colleges, so I don’t know if private colleges would have had the same response. The out of state public costs were over $50K.

So, he’s at Rutgers where we pay about $30K per year. We can afford it, but we can’t take a European vacation any time soon. And certainly no new cars.

Is going to a public college the end of the world? Not at all. For certain kids. Jonah had a very rough first semester, because there is terrible advisement and shaky instruction. But he figured things out by the second semester and found the right people to help choose good classes. Other kids, particularly immature boys, have a tough time in those huge, impersonal environments.

So far, we’re finding that the STEM classes are extremely competitive. He’s getting an Ivy League education in those classes, for sure. The liberal arts classes are hit and miss. Some are fantastic, others are fluffy.

LikeLike

“And no, they don’t take into account past. I wrote letters to several of the financial aid departments explaining the unfunded PhDs. They said they didn’t care.”

By past you mean the further past? Our problem right now is Financial Aid looks at our tax returns from the past 2 years and sees two incomes and thinks, hey, you can pay for this. But we’re on one income right now, and it’s tougher. I guess this year with the lower total income will help out when she’s a senior? Or her brother being in college then will help?

At this point I just want her to have work study so she’s eligible for jobs she will actually apply for. (*grumble*).

LikeLike

While I am sure Laura understands the following points, I wanted to share them for anyone else reading this thread so that they aren’t surprised by these facts during their child’s college search.

1. OOS public colleges and universities are often the worst schools if looking for financial/merit aid. This is due in large part to two factors: state governments reducing the amount of money they give the schools, incentivizing many public colleges and universities to look for OOS students who will pay the higher OOS costs to attend the college, as well as the fact that many states have it written in the college land grants that the duty of state colleges and universities is first and foremost to educate **state residents** and therefore many OOS public colleges and universities use their limited financial aid for in-state resident students *only*.

2. The OOS public colleges and universities that do offer financial/merit aid to OOS students are limited. UVA is one such college that comes to mind, and admission to UVA as an OOS student is almost as competitive as getting into the Ivy League in large part due to UVA’s generous financial aid policies. Alabama is another school that is known for very good merit aid, in large part because they are trying to raise their standing in the rankings, southern schools struggle more for applicants and to bring academically stronger students to their state and even they have started to reduce their awards greatly.

3. Colleges and universities are not going to care about a parent’s student loans because if they did and gave children more aid because the parents had borrowed money for their own education, the college would effectively be paying for part of the indebted parent’s education, as opposed to giving aid to a student whose parents have make less money and don’t have student loans (perhaps in part to not having gone to college). College and universities are well aware of the fungibility of money. And very few colleges actually promise to meet full need, let alone meet the need of those whose FAFSA shows less need than full need.

4. Family medical expenses are sometimes viewed differently, but again – it depends on the endowment of the college being asked for the ‘extra’ money (if they don’t have the money to give as aid – it doesn’t matter how worthy the recipient is) as well as if the school saying they will look at medical expenses as a mitigating factor for a financial aid review. And, most schools will only look at qualifying medical expenses that are incurred over and above that which was covered by insurance. So, they won’t care that insurance paid $100K last year in claims – they will look at the $10K in qualifying expenses the family paid out of pocket and say that the family still can afford to pay for college.

College is really expensive. And we all make choices that make paying for college easier or harder. But as Jay pointed out above those are, in fact, choices. We are currently in the midst of our oldest’s college search and her list is definitely influenced first and foremost by what we know we can afford to pay. We know right now we can’t pay for OOS public schools that cost $50K to attend, so none of those are going on our child’s list. Not narrowly limiting the geographic location of the college has helped us enormously in finding affordable schools that would work for our child. Again, how each family creates the list of colleges to apply to is a decision based on that family’s choices. I just try to to remind myself that we are doing the best we can with the information we have (and to always be trying to get more information, lol).

LikeLike

If you want an OOS, particularly one in a bordering state, check out reciprocity agreements as well. This is likely more relevant to the Midwest than the Mid-Atlantic. The agreements allow an out of state student to attend for in state tuition, or close to it.

LikeLike

Ugg, all my typos are killing me. Apologies.

LikeLike